Research

A Successful Marketing Campaign Begins with Research

Without substantiated data your advertising is just fluff and wasted dollars. To build an effective, cost-efficient marketing strategy, you must begin with research. We analyze your sales and market share, as well as your competitors’ to find the answers to these questions and more.

- What are your strengths and where are the opportunities?

- Where are your battleground zip codes and how can we win those battles?

- Where could we be selling more of a certain model?

- Where can we make shifts in spending to create a more aggressive gameplan?

We dig into demographics so we know exactly who we’re talking to, what their needs are and how to reach them. We get to know you, your philosophy and your goals. From there, we build your brand and your strategy.

A Successful Marketing Campaign Begins with Research

Without substantiated data your advertising is just fluff and wasted dollars. To build an effective, cost-efficient marketing strategy, you must begin with research. We analyze your sales and market share, as well as your competitors’ to find the answers to these questions and more.

- What are your strengths and where are the opportunities?

- Where are your battleground zip codes and how can we win those battles?

- Where could we be selling more of a certain model?

- Where can we make shifts in spending to create a more aggressive gameplan?

We dig into demographics so we know exactly who we’re talking to, what their needs are and how to reach them. We get to know you, your philosophy and your goals. From there, we build your brand and your strategy.

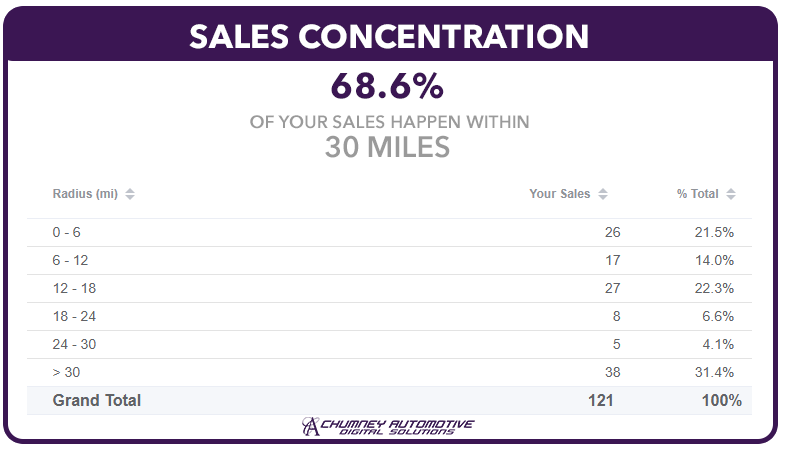

Sales Concentration

We begin by determining where your sales are coming from and how far out we need to go to increase share. Your PMA may encompass 15 miles but, as we all know, it’s rare that you don’t need to go further to really stay on top. If your advertising concentration is too limited, expanding reach will open new doors immediately. But geography is only the beginning. To determine the most cost-effective approach, we dig into the next layer.

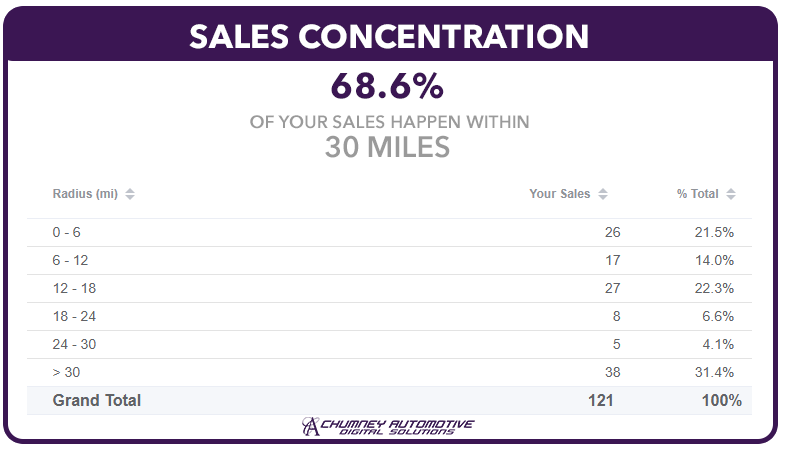

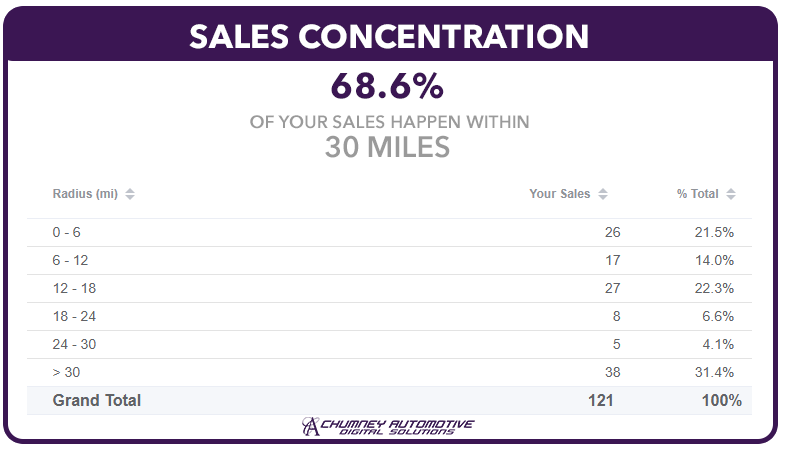

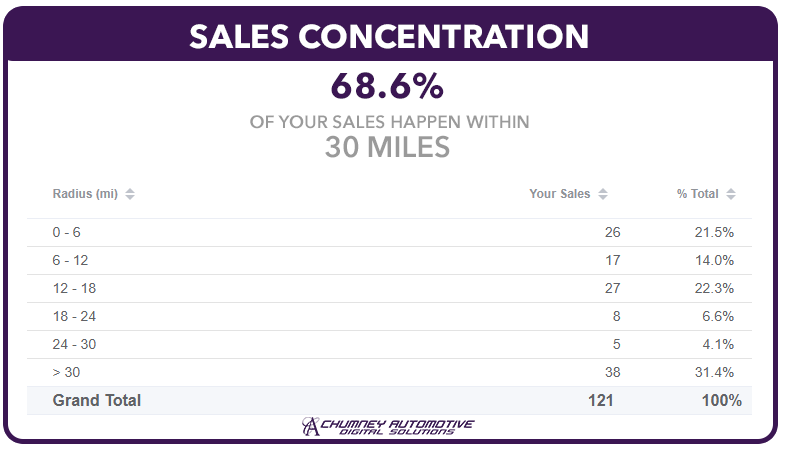

Sales Concentration

We begin by determining where your sales are coming from and how far out we need to go to increase share. Your PMA may encompass 15 miles but, as we all know, it’s rare that you don’t need to go further to really stay on top. If your advertising concentration is too limited, expanding reach will open new doors immediately. But geography is only the beginning. To determine the most cost-effective approach, we dig into the next layer.

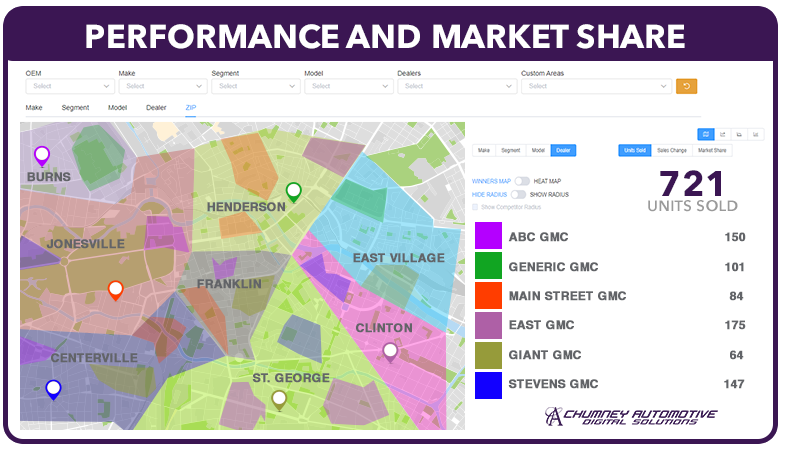

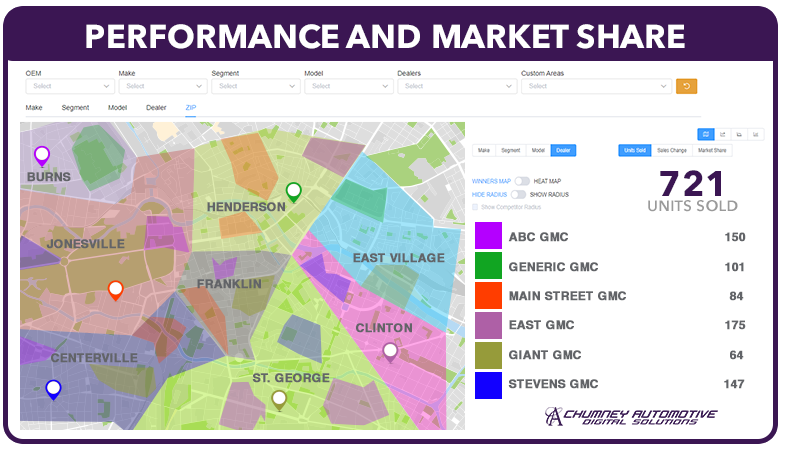

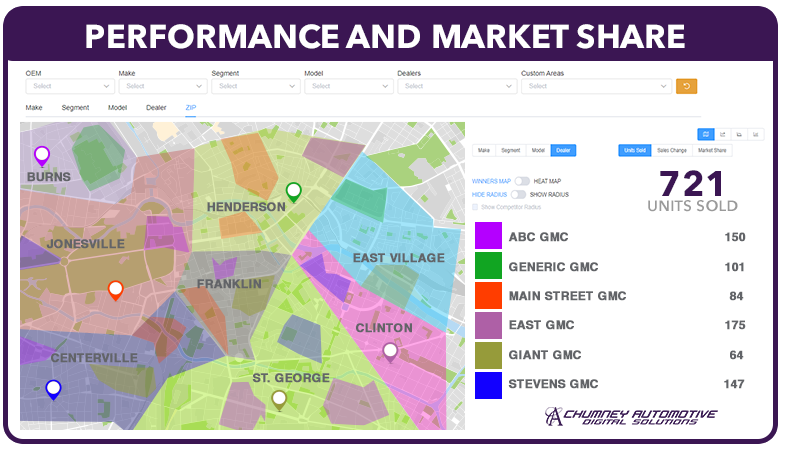

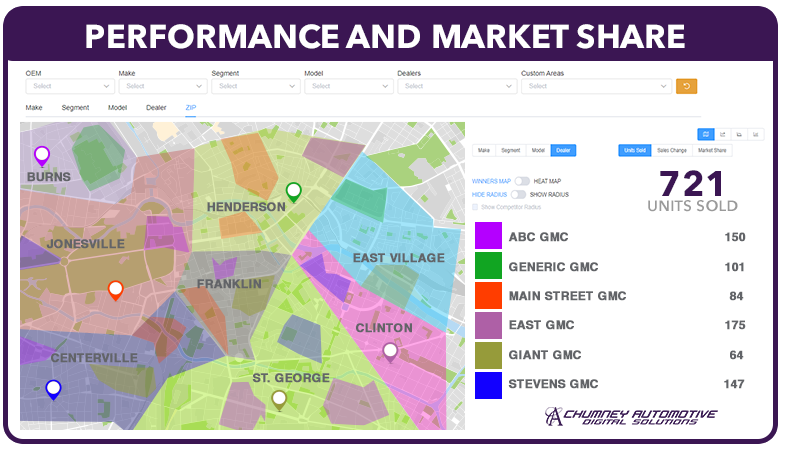

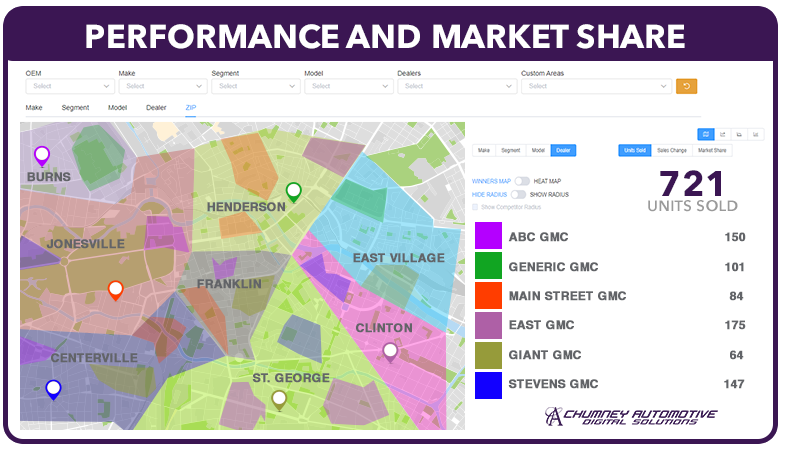

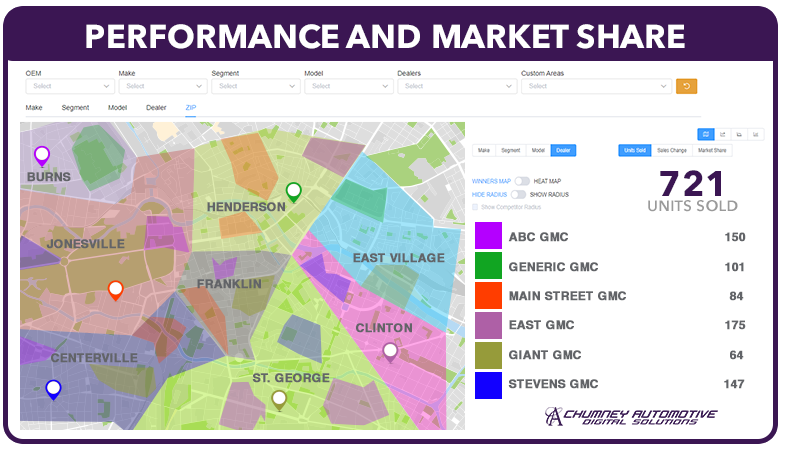

Performance and Market Share

Sales volume means nothing if your market share isn’t where it should be. Even in the midst of inventory woes, monitoring market share will always tell the full story. Who are your strongest competitors and what zip codes hold untapped opportunity for you? When we see competitive dealerships invading your territory, we develop a strategy to regain your share and keep it strong. We also look at which zips are strongest for your vehicle brand and how we can concentrate specific efforts in those areas to rise to the top.

Performance and Market Share

Sales volume means nothing if your market share isn’t where it should be. Even in the midst of inventory woes, monitoring market share will always tell the full story. Who are your strongest competitors and what zip codes hold untapped opportunity for you? When we see competitive dealerships invading your territory, we develop a strategy to regain your share and keep it strong. We also look at which zips are strongest for your vehicle brand and how we can concentrate specific efforts in those areas to rise to the top.

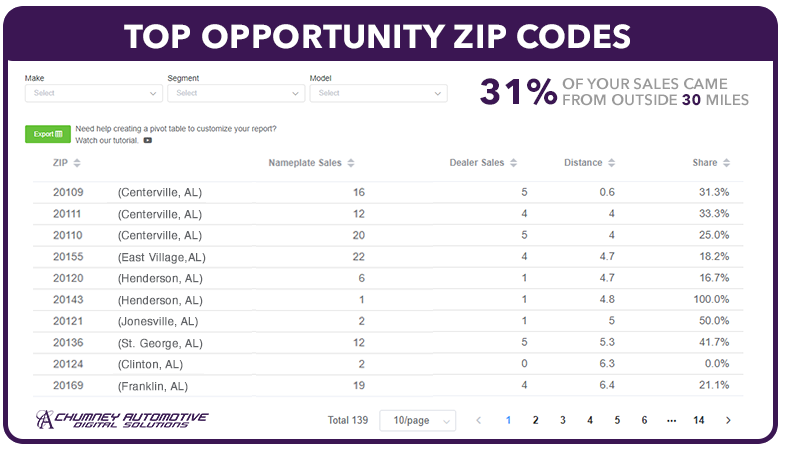

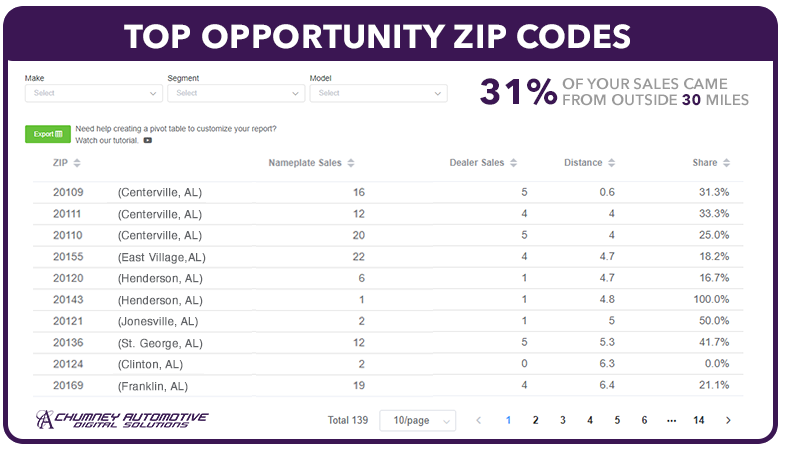

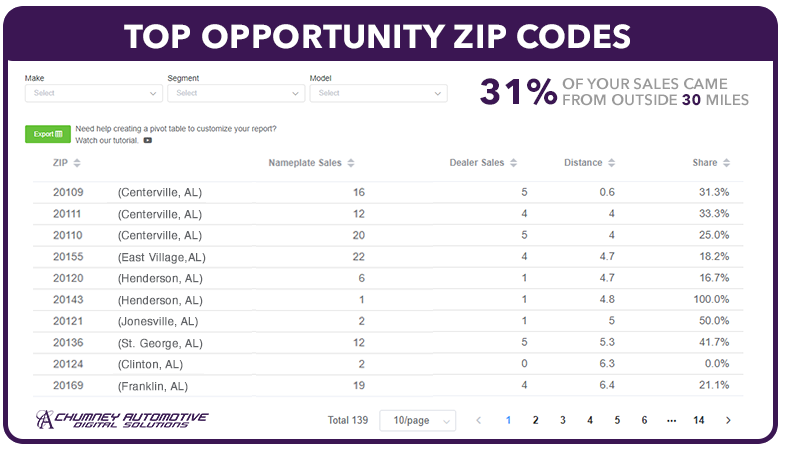

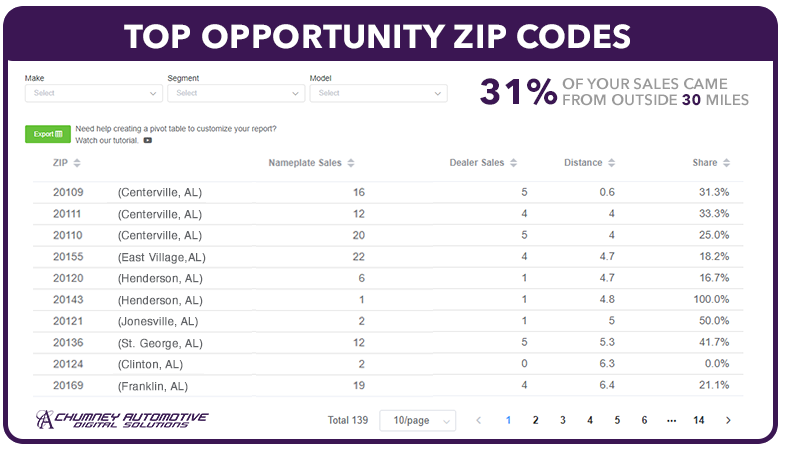

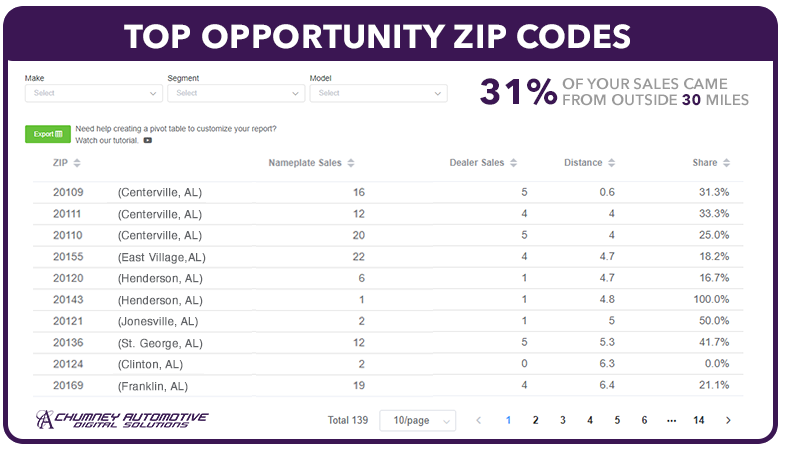

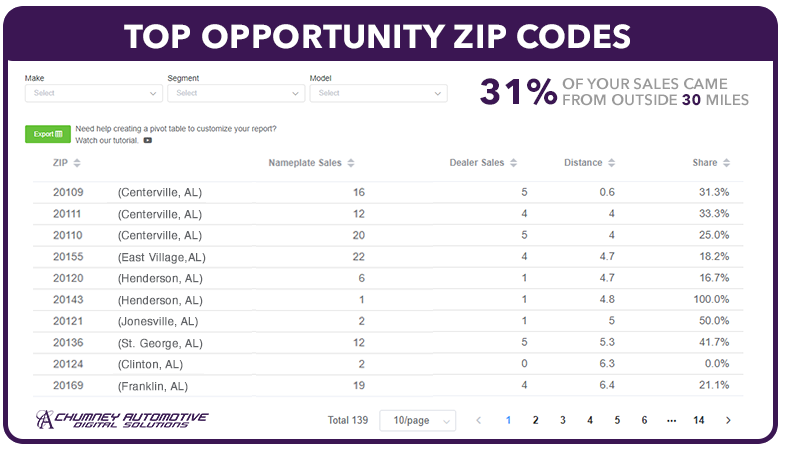

Top Opportunity Zip Codes

We rarely believe in a simple radius approach. We determine which zips are your battleground zips, which are your maintain-your-share zips and which zips aren’t that important due to lack of population or total sales of a certain brand. We create bid and reach strategies to optimize the opportunity zips and eliminate waste in the others.

Top Opportunity Zip Codes

We rarely believe in a simple radius approach. We determine which zips are your battleground zips, which are your maintain-your-share zips and which zips aren’t that important due to lack of population or total sales of a certain brand. We create bid and reach strategies to optimize the opportunity zips and eliminate waste in the others.

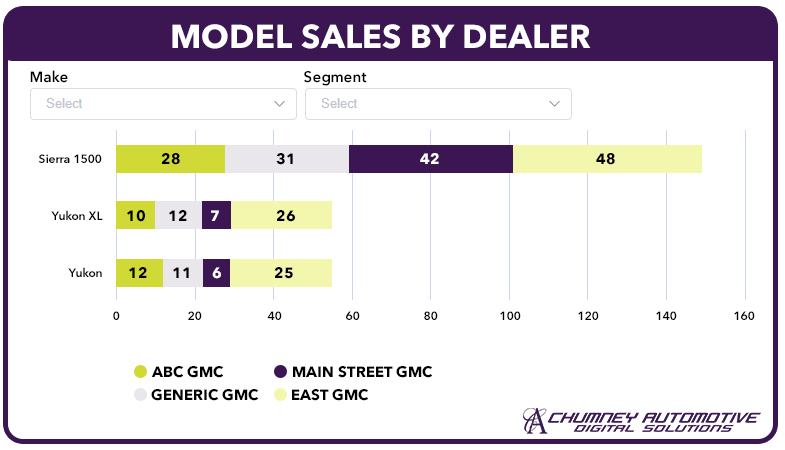

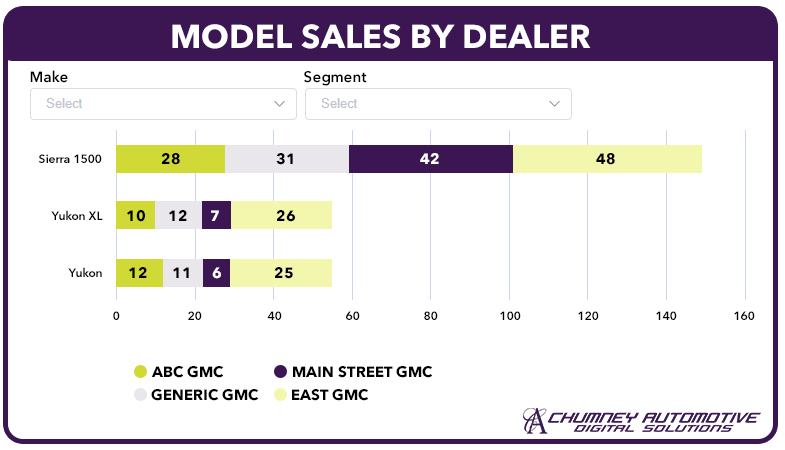

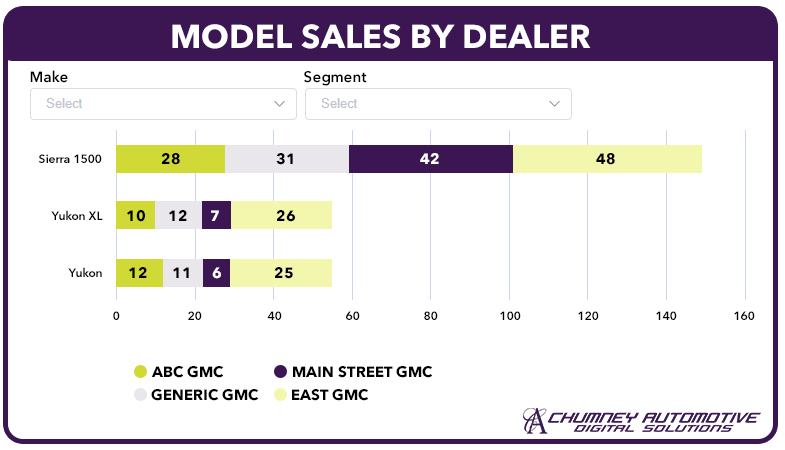

Model Sales by Dealer

Once geographical parameters have been set, we look at individual model sales. We may need to push trucks in one area and SUVs in another. Or we may need to refine the messaging consumers see in certain areas to combat a competitor’s message or brand image.

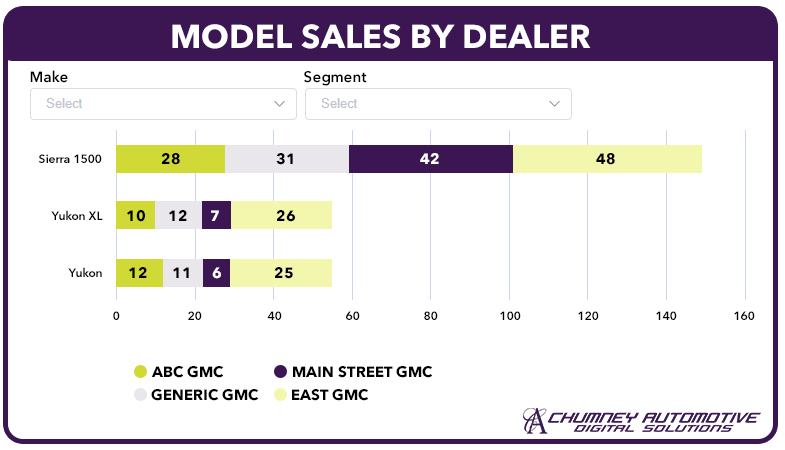

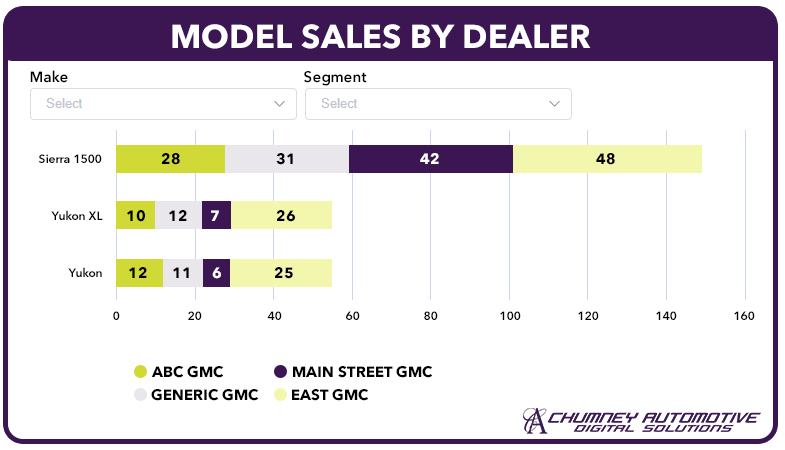

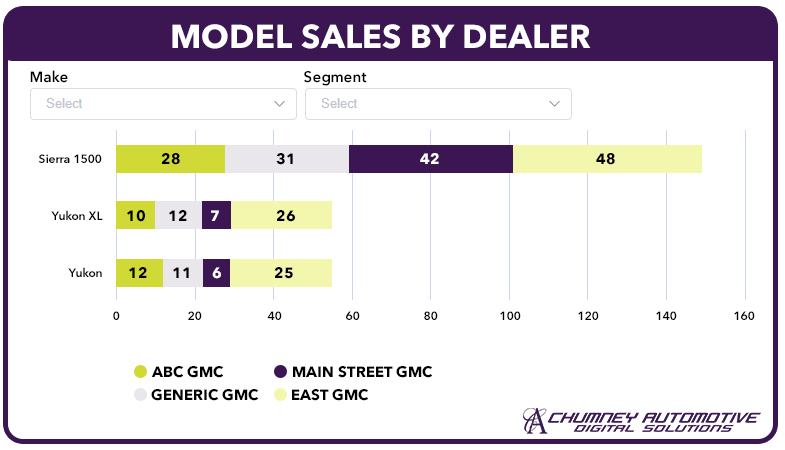

Model Sales by Dealer

Once geographical parameters have been set, we look at individual model sales. We may need to push trucks in one area and SUVs in another. Or we may need to refine the messaging consumers see in certain areas to combat a competitor’s message or brand image.

Let’s get started today!

Introduce yourself and let one of our skilled marketing professionals provide you with a free, no obligation market analysis – custom to your store and market.

Let’s get started today!

Introduce yourself and let one of our skilled marketing professionals provide you with a free, no obligation market analysis – custom to your store and market.